We investigate whether buying one of the art world’s biggest names could deliver a higher return than the stock exchange

What motivates you to buy art? While many collectors follow the old art market adage of ‘buy what you love’, for others, it’s important to know that a prospective purchase could represent a sound investment in years to come. To assess art’s potential to deliver a healthy return, we pitted the historic performance of Jean-Michel Basquiat’s works against the Nasdaq – exploring whether the artist’s market could outstrip the American stock exchange.

Record-breaking returns

Born in Brooklyn, New York, in 1960, Jean-Michel Basquiat was a virtual unknown until 1980, when his work featured in The Times Square Show – a group exhibition with artists including Kenny Scharf and Keith Haring. Two years later, his first solo show sold out, with critics lauding the raw, radical style of his paintings. Today, 1982 continues to be viewed as the artist’s most significant year, and Basquiat himself declared it was when he ‘made the best paintings ever’.

JEAN-MICHEL BASQUIAT IN HIS STUDIO

It’s perhaps no surprise that works dating from 1982 have generated some of Basquiat’s highest sale prices. In 2017, Untitled (1982) made headlines when it sold for $110,487,500 at Sotheby’s in New York, to Japanese collector Yusaku Maezawa. The figure represented a record for an American artist at auction, and the highest-ever price paid at auction for a work created after 1980. As remarkable was the work’s increase in value: Untitled (1982) had last been auctioned at Christie’s in May 1984 for just $19,000.

JEAN-MICHEL BASQUIAT, UNTITLED, 1982

The significant increase in the value of Untitled (1982) between 1984 and 2017 gives the work an IRR – or annualised growth rate – of 30%. During the same period, the Nasdaq delivered a comparatively subdued 10.1%. Put differently, had you invested $19,000 in the Nasdaq in 1984, by 2017 you’d have $457,717 – significantly less than the nine-figure sum achieved by Sotheby’s.

Assessing investment potential

While the sum achieved for Basquiat’s Untitled (1982) was record-breaking, high resale values are not an isolated phenomenon in the artist’s market – nor are they restricted to works from his most famous year. In 2019, Sotheby’s sold Apex (1986) for £8,227,960 with fees – far surpassing the work’s previous sale price of £16,500, achieved at Christie’s 1988. In 2013, Phillips sold Head; Rinso; Per Capita; and Ernok (1983) for $161,000, up from $32,093 in 2010.

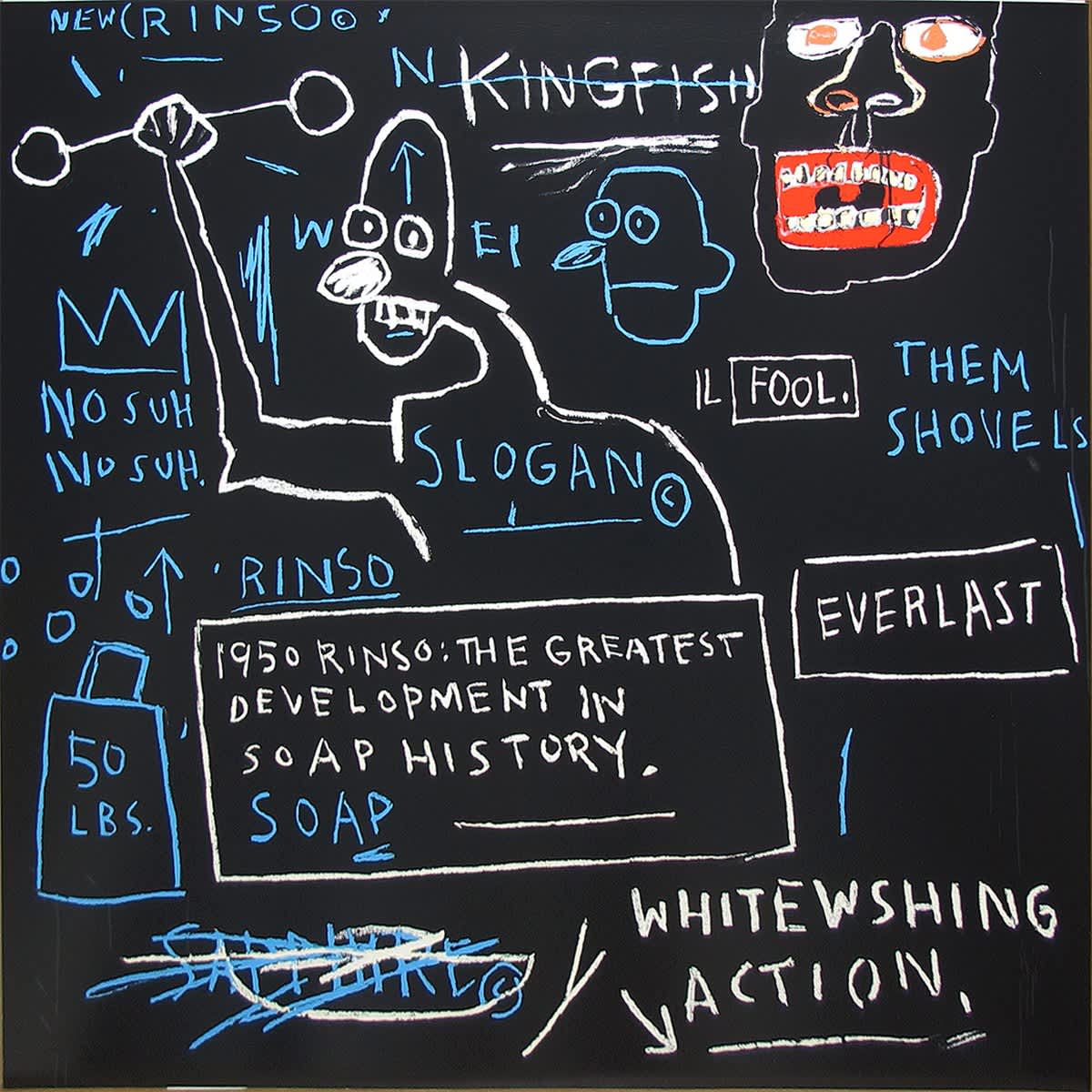

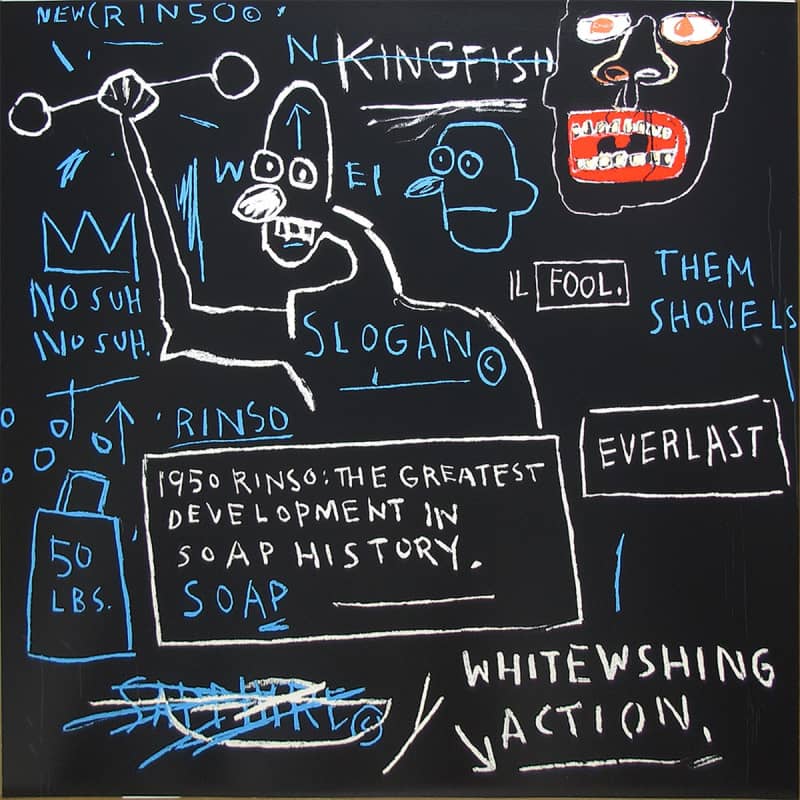

JEAN-MICHEL BASQUIAT, RINSO, 1983/2001

For anyone eager to collect art as an investment, Basquiat’s historic market performance is promising. Repeat sales of the artist’s work indicate the potential for healthy return – a factor which might be highly appealing if you choose to sell items from your collection in the future, or pass them to future generations. Eager to learn more? Maddox Art Advisory service can provide additional insight into the market, and bespoke advice tailored to your investment goals – whether steady growth over time, or a race against the Nasdaq.

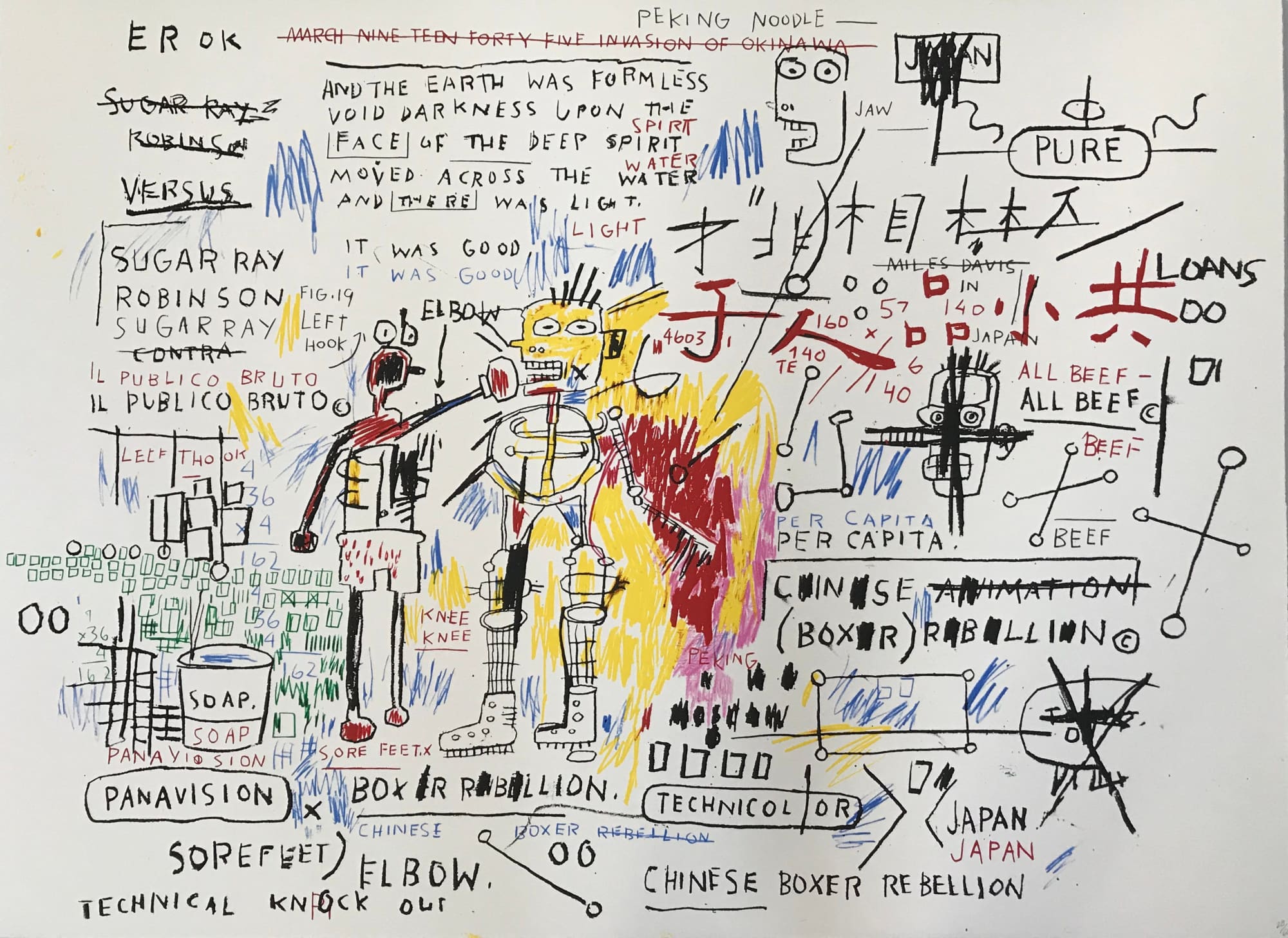

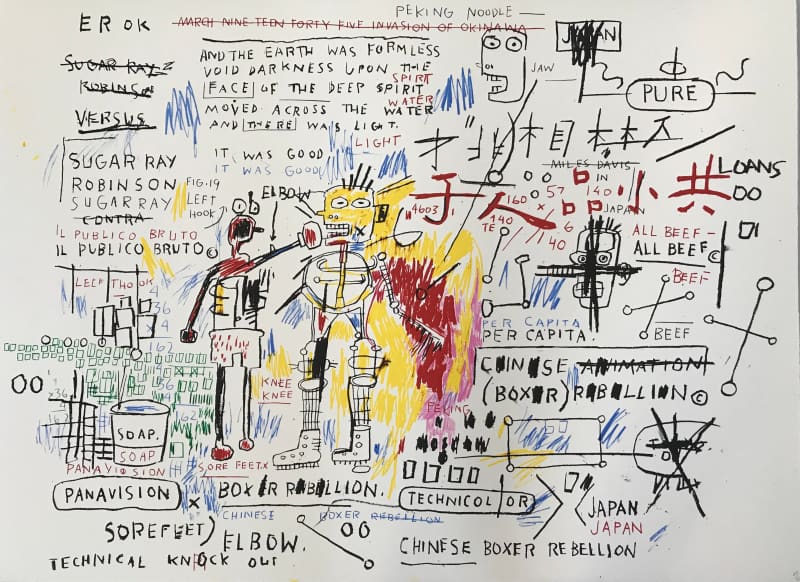

JEAN-MICHEL BASQUIAT, BOXER REBELLION, 2018